Scammers target taxpayers as they prepare their tax returns or hire someone to do so.

It’s that time of the year again – tax season is upon us.

Recently, the Internal Revenue Service wrapped up its annual “Dirty Dozen” list of tax scams. This year, identity theft topped the list, but phone scams and phishing schemes also deserve special mentions. It’s important that taxpayers guard against ploys to steal their personal information, scam them out of money or talk them into engaging in questionable behavior with their taxes. While discussing the topic of tax scams, IRS Commissioner John Koskinen said:

“We are working hard to protect taxpayers from identity theft and other scams this filing season. . .Taxpayers have rights and should not be frightened into providing personal information or money to someone over the phone or in an email. We urge taxpayers to help protect themselves from scams — old and new.”

In addition to releasing the “Dirty Dozen” list, the IRS has also renewed a consumer alert for email schemes. This renewal came after seeing an approximate 400 percent surge in phishing and malware incidents so far this tax season.

We encourage taxpayers to review the list in a special section on IRS.gov and be on the lookout for the many different forms of tax scams. Many of these con games peak during filing season as people prepare their tax returns or hire someone to do so.

Taking a closer look at this year’s “Dirty Dozen” scams

Here‘s what you should keep your eyes open for throughout this tax season:

Identity theft: Taxpayers need to watch out for identity theft — especially around tax time. The IRS continues to aggressively pursue the criminals that file fraudulent returns using someone else’s Social Security number. Though the agency is making progress on this front, taxpayers still need to be extremely careful and do everything they can to avoid being victimized.

Phone scams: Phone calls from criminals impersonating IRS agents remain an ongoing threat to taxpayers. The IRS has seen a surge of these phone scams in recent years as scam artists threaten taxpayers with police arrest, deportation and license revocation, among other things.

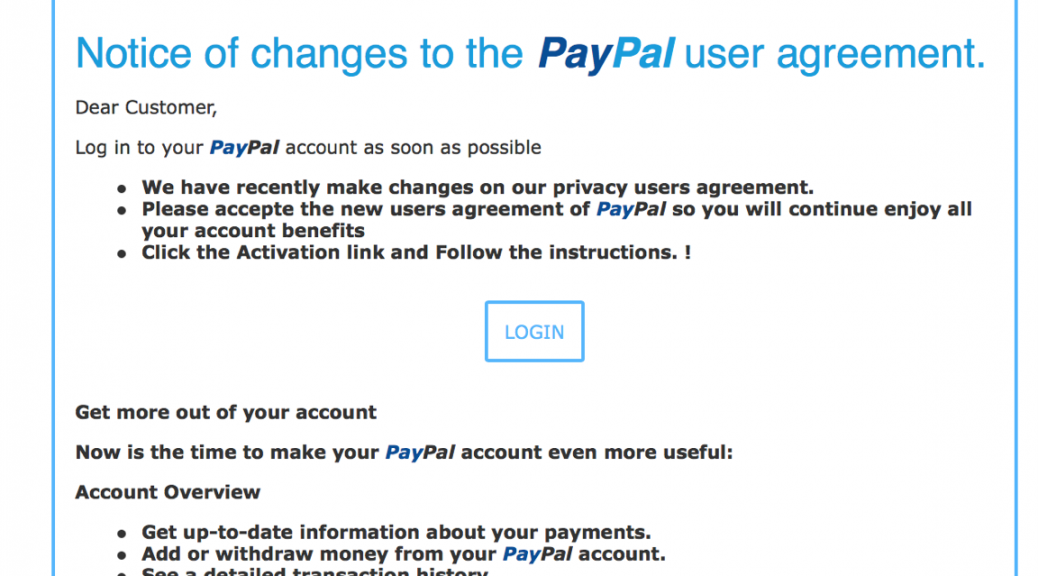

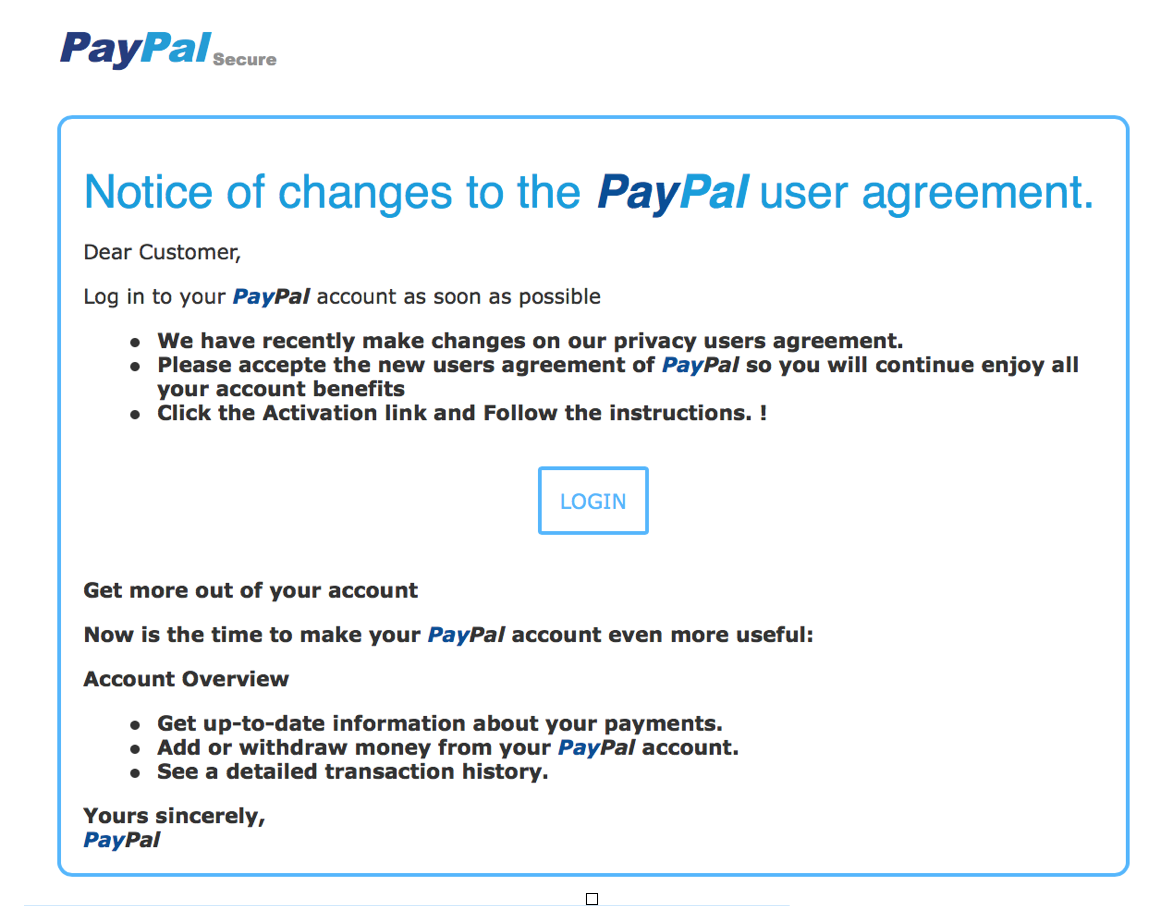

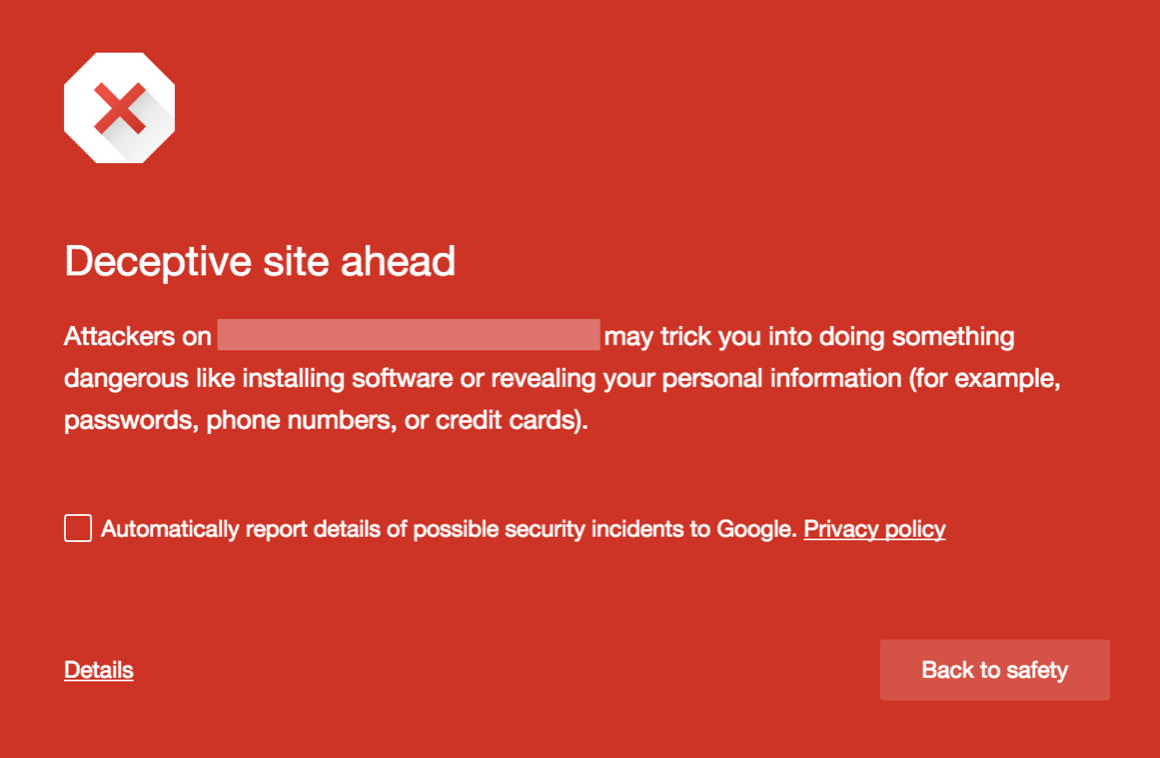

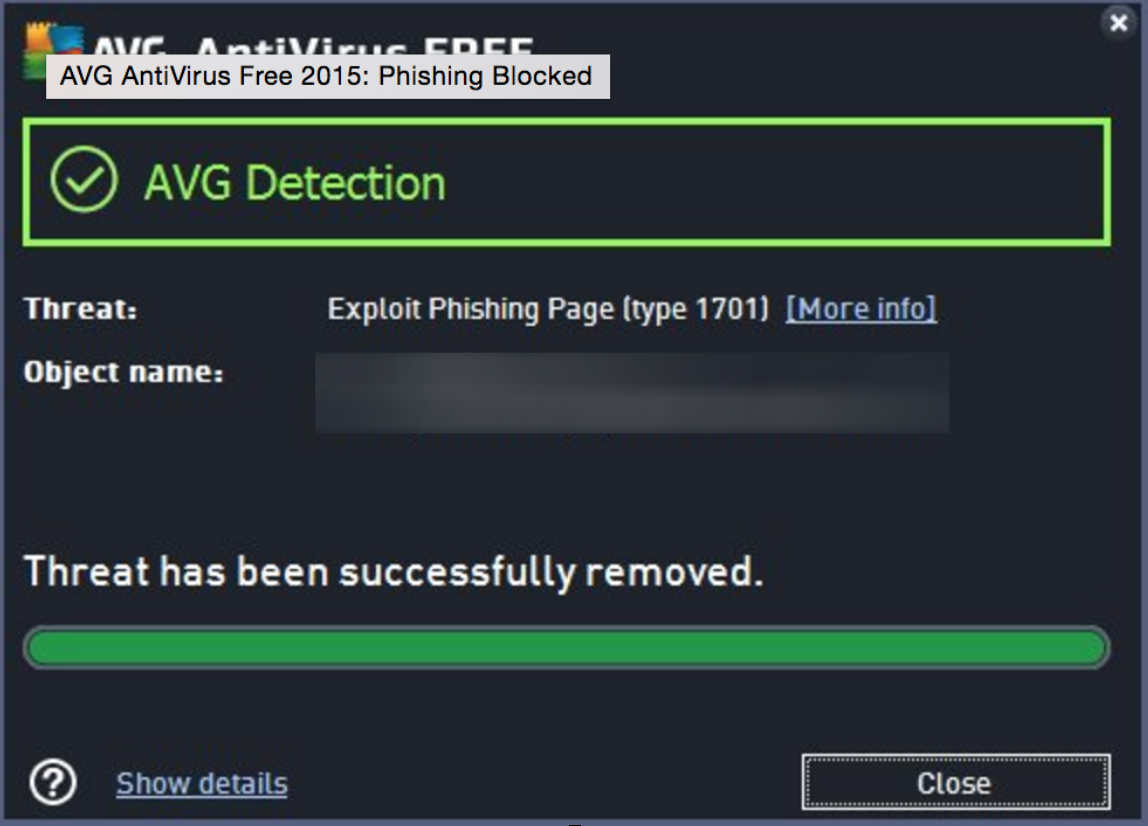

Phishing: Taxpayers need to be on guard against fake emails or websites looking to steal personal information. The IRS will never send taxpayers an email about a bill or refund out of the blue, so don’t click on one claiming to be from the IRS.

Return preparer fraud: Be on the lookout for unscrupulous return preparers. The vast majority of tax professionals provide honest high-quality service, but there are some dishonest preparers who set up shop each filing season to perpetrate refund fraud, identity theft and other scams that hurt taxpayers.

Offshore tax avoidance: The recent string of successful enforcement actions against offshore tax cheats and the financial organizations that help them shows that it’s a bad bet to hide money and income offshore. Taxpayers are best served by coming in voluntarily and getting caught up on their tax-filing responsibilities.

Inflated refund claims: Be wary of anyone who asks taxpayers to sign a blank return, promises a big refund before looking at their records, or charges fees based on a percentage of the refund. Scam artists use flyers, ads, phony store fronts and word of mouth via trusted community groups to find victims.

Fake charities: Be on guard against groups masquerading as charitable organizations to attract donations from unsuspecting contributors. Contributors should take a few extra minutes to ensure their hard-earned money goes to legitimate and currently eligible charities.

Falsely padding deductions on returns: Taxpayers should avoid the temptation of falsely inflating deductions or expenses on their returns to under pay what they owe or possibly receive larger refunds.

Excessive claims for business credits: Avoid improperly claiming the fuel tax credit, a tax benefit generally not available to most taxpayers. The credit is generally limited to off-highway business use, including use in farming. Taxpayers should also avoid misuse of the research credit.

Falsifying income to claim credits: Don’t invent income to wrongly qualify for tax credits, such as the Earned Income Tax Credit. Taxpayers are sometimes talked into doing this by scam artists. This scam can lead to taxpayers facing big bills to pay back taxes, interest and penalties and in some cases, criminal prosecution.

Abusive tax shelters: Don’t use abusive tax structures to avoid paying taxes. The vast majority of taxpayers pay their fair share, and everyone should be on the lookout for people peddling tax shelters that sound too good to be true. When in doubt, taxpayers should seek an independent opinion regarding complex products they are offered.

Frivolous tax arguments: Don’t use frivolous tax arguments in an effort to avoid paying tax. Promoters of frivolous schemes encourage taxpayers to make unreasonable and outlandish claims even though they are wrong and have been repeatedly thrown out of court. The penalty for filing a frivolous tax return is $5,000.

Proceed with caution while filing taxes

Perpetrators of illegal scams can face significant penalties and interest and possible criminal prosecution. IRS Criminal Investigation works closely with the Department of Justice to shut down scams and prosecute the criminals behind them. Taxpayers should remember that they are legally responsible for what is on their tax return even if it is prepared by someone else. Be sure the preparer is up to the task.

For more information about tax scams, check out the IRS on YouTube.

Follow Avast on Facebook, Twitter, YouTube, and Google+ where we keep you updated on cybersecurity news every day.

![]()