I’ve long been a fan of Apple Pay and the fact that it is finally available in my homeland, the UK, is a good thing.

While most Americans are still using credit card magstripes to make payments, a few early adopters have been using Apple Pay since it was released around a year ago in the US. I am one of them, and I have to admit I’m impressed.

First and most obviously, there’s the convenience of being able to make small purchases quickly and easily using just my phone. No more digging around for my wallet or cash but a quick bleep and I’m done.

Next is the security. Paying with Apple Pay isn’t just convenient but secure as well. When you hover over the contactless payment point, you use the Touch ID to authenticate the transaction, making it much more secure than the contactless credit and debit cards already in use in the UK which have no authentication at all and can be used by anyone for small purchases.

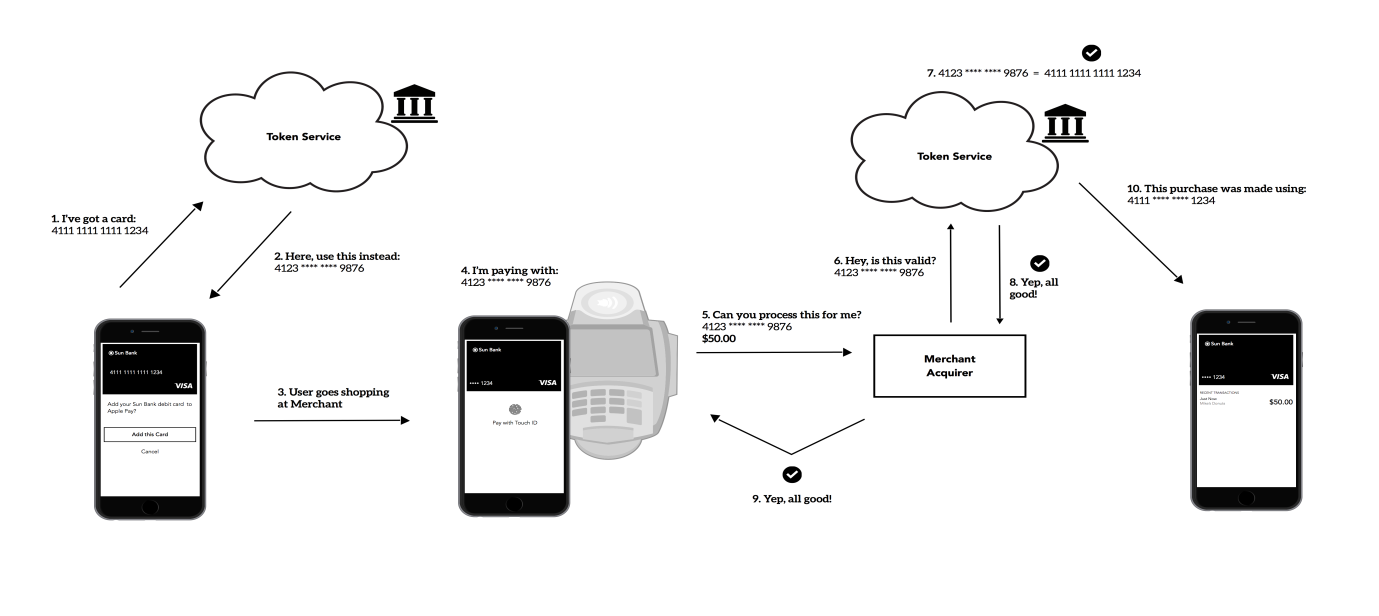

Apple Pay also helps protect your privacy thanks to Apple’s Unique Device Account Number. A system specifically designed for Apple Pay, using a Unique Device Account Number means that Apple never needs to transmit or share your actual card or banking details with the merchant. This adds a significant layer of protection for your payment data.

For more information on how mobile payments work check out this blog from my colleague Judith Bitterli and these three trends from Charlie Sanchez.

In You can follow me on Twitter @TonyatAVG and find my Google+ profile here.

![]()

![]()