The summer sales are upon us and there are plenty of good deals to be had online, but internet shopping is not without its dangers.

The post How to shop online safely during the summer sales appeared first on We Live Security.

![]()

The summer sales are upon us and there are plenty of good deals to be had online, but internet shopping is not without its dangers.

The post How to shop online safely during the summer sales appeared first on We Live Security.

![]()

When it comes to planning a purchase online, customer reviews can be a great source of information and a crucial part of the decision making process. But with cases of businesses doctoring their online reviews emerging, how can you be sure that the review you’re reading can be trusted?

Here are some signs to watch out for to make sure you don’t get the wool pulled over your eyes.

Your first point of reference should be the person who left the review. They are more likely to be a legitimate person if the following checks out:

All of these point to the behaviors of a real person who can be deemed impartial. If the review has only just joined the site or only left a review for the product or service in question, then you may want to consider basing your purchase on their advice.

Many websites run employ services such as Revoo to help provide transparent and authentic feedback on their products. The review is actually part of the purchasing process so that you can be sure that only those that actually purchased the product have left a review.

If you’re shopping for a big ticket item or booking at a pricey hotel, it is definitely worth checking reviews on many different sites and even social networks.

If something has great reviews on Yelp or Google Reviews, may have a bad rating on Trip Advisor, Amazon or another service. If the reviews differ significantly, it is certainly worth investigating a little further into them.

A quick search on Facebook or Twitter doesn’t hurt either. Check out any mentions of the product name or if a restaurant or hotel, visit their Twitter page to see how people are engaging with them. If there’s a lot of angry customers complaining, you may want to think twice before booking!

Do you have any tips to get trusted review online? Let me know on Twitter or on Facebook.

![]()

![]()

Now the favorite past time of some (namely taking selfies!) might actually become a legit payment method for MasterCard users. The company is experimenting with a feature called ID Check, which would scan your face (or your fingerprint, depending on what you choose) in order to approve an online purchase. Basically they are trying to go full blown biometric.

Ajay Bhalla, the MasterCard executive who’s in charge of the new payment methods told CNN: “The new generation, which is into selfies … I think they’ll find it cool. They’ll embrace it.“

Why MasterCard would do something like that? Definitely not only to please us youngster, but also to cut down fraud, it seems. The US trial is supposed to start very soon with a limited customer base of 500. The launch will follow sometime after that.

If you’re afraid that you’ll need a selfie stick in order to make payments with your MasterCard in the future, don’t worry too much: The way the system is described you’ll just install the MasterCard app, purchase something, and once you want to pay a pop up appears. Now you can choose to complete the payment with a fingerprint scan or via said selfie. According to CNN “you stare at the phone — blink once — and you’re done. MasterCard’s security researchers decided blinking is the best way to prevent a thief from just holding up a picture of you and fooling the system.” Easy peasy, right?

Well, let’s see how it will work out and what’s next: Bhalla also said that MasterCard is experimenting with voice recognition and approving transactions by recognizing your heartbeat …

The post Shopping via Selfie is the next thing … appeared first on Avira Blog.

One of the largest e-commerce platforms, Magento, has been plagued by hackers who inject malicious code in order to spy and steal credit card data or any other data a customer submits to the system. More than 100,000+ merchants all over the world use Magento platform, including eBay, Nike Running, Lenovo, and the Ford Accessories Online website.

The company that discovered the flaws, Securi Security, says in their blog, “The sad part is that you won’t know it’s affecting you until it’s too late, in the worst cases it won’t become apparent until they appear on your bank statements.”

Minimize your risk for identity theft when shopping online

Data breaches are nothing new. The Identity Theft Research Center said there were 761 breaches in 2014 affecting more than 83 million accounts. You probably recall the reports of Sony, Target, Home Depot, and Chic Fil A.

We have heard lots about what we as individual consumers can do to protect ourselves: Use strong passwords, update your antivirus protection and keep your software patched, learn to recognize phishing software, and be wary of fake websites asking for our personal information.

But this kind of hack occurs on trusted websites and show no outward signs that there has been a compromise. The hackers have thoroughly covered their tracks, and you won’t know anything is wrong until you check your credit card bill.

![]()

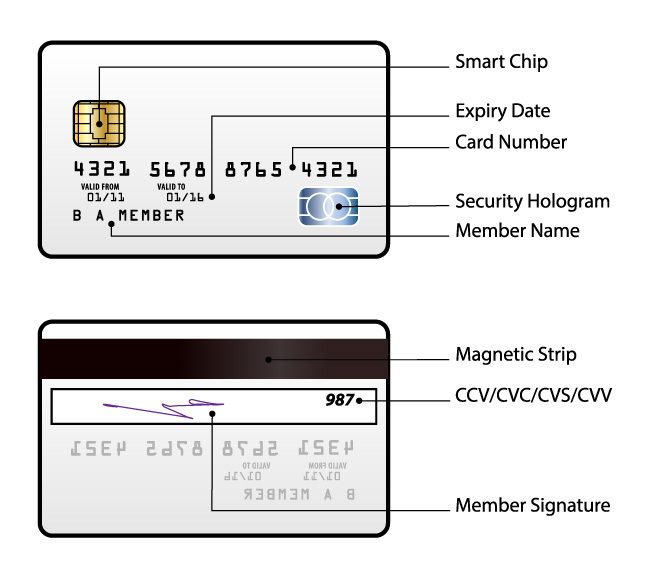

If you’re a regular online shopper like me, you’re sure to be familiar with your credit card security code – otherwise known as the card verification value (or CVV).

If not, you can find the 3-4 digit code on the back of your VISA/MasterCard (the final 3 digits of the number printed on the signature strip) or on the front of your Amex card (the separate 4 digit code above the card number).

The intended purpose of the CVV is to provide added security when making purchases over the internet – it helps to verify that you’re in possession of the card, as the code shouldn’t be known to anyone other than you as the card holder. So it’s essentially a way of counteracting credit card fraud.

For online shopping, the answer is generally yes – it’s just simply a good idea to stick with well-known, reputable companies that you trust. You’ll find that most online retailers nowadays do require a CVV for purchases, which is encouraging because it means that they’re actively trying to prevent fraudulent transactions occurring on their site.

You may also be asked for your credit card security code when processing a payment over the telephone. As with online transactions, it’s usually safe to do this – you just need to be sure that no one overhears the details you give out (so avoid public places when doing this).

On the other hand, when purchasing an item or service in person, you should never provide the details of your CVV. In fact, there’s no need for the retailer or service provider to request this – it doesn’t show up when the card is scanned normally and they have other ways of verifying that you’re the authorised card holder (signature or another form of identification) should they need to.

Handing over your CVV for purchases completed offline serves no purpose other than providing someone with the opportunity to steal the information. Because if they were to do this, they’d have everything they need to go ahead and make a bunch of fraudulent online transactions – on you!

To avoid any issues with security or credit card fraud, there are a few things you can do:

Have you had any dramas when using your credit cards online? Share your story with us below.

The holidays are here and many are opting to shop online for their holiday gifts, whether it’s to avoid the crowds or because time is running out. Online shopping is a convenient option, everything is almost guaranteed to be in stock, there are no lines and your purchase gets delivered to your doorstep. But, can this season’s holiday shopping come back to haunt you online?

Ad networks, whether via browser extensions or cookies, track your online browsing activities to target ads tailored to your interests. Some see this is as a good thing as you are only shown ads for products or services that would be useful for you, while others may think it’s creepy that the Internet knows about your guilty pleasures. The holidays are about giving and generosity, so your online browsing activities may differ from what they are the other eleven months of the year. You may be researching whether you should purchase a round or square shovel for Uncle Jack, who put gardening tools on his holiday wish list, or which game you should order for your daughter. Now, do you really want to have ads for gardening tools and games for kids following you around the Internet?

How to shop undercover

Whether you want to protect your privacy or simply want to avoid targeted ads that may result from holiday shopping for family and friends, Avast is here to help!

Avast Online Security comes with a Do Not Track feature. Do Not Track identifies tracking software and shows you a list of all tracking and analytics programs that are trying to track your online behavior. You then have the option to choose which tracking software you want to deny or allow to track your online behavior.

By denying tracking software, you eliminate your digital footprint and exclude targeted ads from following you while you browse. Most browsers do come with some form of Do Not Track, but they rely on HTTP Do Not Track headers. Avast on the other hand uses proprietary technology that cannot be overridden by servers.

Avast Browser Cleanup is another tool that will help ward off targeted ads. Browser Cleanup removes unwanted or poorly rated toolbars that could also be keeping an eye on your browsing sessions. Since Avast Browser Cleanup launched in February 2013, it has identified more than 40 million different toolbars, 95 percent of which have been rated as “bad” by Avast users.

Leave the tracking this holiday season to shipping companies and the post office, not online advertising! Avast wishes you and your loved ones safe and happy holidays (and shopping ![]() )!

)!

Avast Software’s security applications for PC, Mac, and Android are trusted by more than 200-million people and businesses. Please follow us on Facebook, Twitter and Google+.

With so many retailers offering great deals online, its important to be extra wary of cyber criminals looking to take advantage. Keep in mind these 5 must dos on Cyber Monday.

The post 5 must do’s for a safer Cyber Monday appeared first on We Live Security.

Cyber Monday is one of the biggest shopping days in the year, and in 2013 a massive $2.3bn was spent on shoppers getting their Christmas bargains in. Where this kind of money is flowing, cybercriminals are also around though, as this infographic shows.

The post Infographic: Cyber Monday – Everything you need to know appeared first on We Live Security.

![]()

Cyber Monday, the start of the digital holiday shopalooza, has occupied its role for nearly 10 years – starting in 2005. Though it still trails brick-and-mortar shopping on Black Friday in popularity, Cyber Monday shoppers spend more! According to an AOL study in 2013, Cyber Monday shoppers spent an average of $468 versus $309 spent on Black Friday.

Another data point of interest: Cyber Monday is an increasingly popular shopping experience for Boomers. Â Nielsen research found the percent of customers aged 50-64 who visited online retail sites increased 20.5% and for age 65+ it was up 40% from 2011 to 2012.

In 2014 millions of consumers, and not just online shoppers, were affected by a series of major data breaches, along with malware, phishing, and identity theft. It’s enough to dampen the holiday shopping spirit. But there are ways to stay safe, shop online, and get the great deals offered on Cyber Monday.

Cyber Monday is a great way to get a jump on the holidays and avoid the crazy crowds of Black Friday. Just stay safe and enjoy!

![]()

![]()

Retailers have been “leaking†special Black Friday deals since before Buffalo got covered in a snow wall, and that flurry of sales results in the annual spike that carries them through the rest of the year. But analysts who study these things warn that cybercrooks are riding the sales wave with a surge in attacks due to relaxed security measures.

The Wall Street Journal quotes Gartner Inc’s vice president Avivah Litan,

Retail transaction volume increases by 50% during the holidays and retailers don’t want to stop to slow the pace of business, so they relax fraud controls to some degree. Criminals know they’re likely to get away with more.

Yikes! That’s not good news for consumers, especially since we are swiping our credit and debit cards at places like Target, The Home Depot, and Neiman Marcus – all victims of point-of-sale terminal hacks this year. Experts have advised retailers to take action, like upgrading terminals with new technology and enabling chip embedded cards, but all that takes time to implement.

It’s not much better online. Attacks during last holiday shopping season, November 14, 2013 through January 9, 2014 increased by 264% over the weeks prior to that time, says security company Imperva.The reason?

Cybercrooks believe that retail applications are more vulnerable during this time of the year, and that attacks are more likely to succeed. Isn’t that what the Gartner analyst said about brick-and-mortar retailers?

The reasoning is similar – in order not to annoy shoppers who can go elsewhere, online retailers relax strict security measures such as step-up authentication and Captcha. Add that easy check-out to all those new Black Friday and CyberMonday quick campaign webpages, (“bad design, unsafe coding, and usage of insecure third-party librariesâ€) and cybercrooks get an early Christmas present in the form of your credit card number and possible stolen identity.

How to protect yourself during Black Friday

Avast Software’s security applications for PC, Mac, and Android are trusted by more than 200-million people and businesses. Please follow us on Facebook, Twitter and Google+.